Divergent monetary policies and the world economy, by Vítor Constâncio, Vice-President of the ECB

Autor: Bancherul.ro

Autor: Bancherul.ro

2015-10-16 11:03

Divergent monetary policies and the world economy

Keynote address by Vítor Constâncio, Vice-President of the ECB,

at the conference organised by FED/ECB/FED Dallas/HKMA in Hong Kong,

15 October 2015

We live in an increasingly globalised world. The responsiveness of financial markets to monetary policy announcements is prima facie evidence that the exit from the zero lower bound may have potent spillovers on other countries in the short run. The medium-term impact of monetary policy spillovers is however much less clear-cut than frequently assumed in policy debates. Looking forward, central banks play an important role in preserving price and financial stability in their own constituencies, but also in stabilising the global financial system. However, it would be a misconception to believe that central bank actions alone are enough. Central banks have to respond to their own economies’ fundamentals but “putting their house in order” is not enough to ensure a suitable global economic environment. Global challenges require domestic and global responses to make the financial system more resilient.

Introduction

Ladies and Gentlemen,

It is a pleasure for me to speak at this joint conference on “Diverging Monetary Policies, Global Capital Flows and Financial Stability” hosted by the Hong Kong Monetary Authority. [1]

The current international environment poses a number of important challenges to policy makers, such as the decline in commodity prices, remaining global imbalances and a synchronized growth slowdown in emerging economies with worldwide consequences. I could continue this list even further. From a central banking perspective, however, an obvious challenge in the coming months will be the divergence between the monetary policy stance in the US and other major advanced economies.

When divergences reflect differences in fundamentals, as it is the case between the US and the Euro Area, the traditional view was that no problems would be created to the global economy. However, this time the divergences could have greater global repercussions than in the past.

This might be the case due to four momentous developments that the global economy has witnessed over recent years. First, several emerging economies – China in particular – have integrated in the global economy to an unprecedented degree. Second, the increasing international fragmentation of production has given rise to tight links between countries along the global value chain. Third, the liberalisation of capital flows and the rise of global banks have brought about strong cross-border financial linkages. Fourth, the zero lower bound has rendered central bank balance sheets and forward guidance crucial monetary policy instruments.

There is compelling “prima-facie” evidence that monetary policy in major advanced economies has significant spillovers to the global economy, at least in the short term. I refer here to the high sensitivity of global bond yields and exchange rates to recent monetary policy announcements in the US and the euro area. Likewise, the changes in market expectations about the timing of US monetary policy tightening have given rise to bouts of financial market volatility. [2] However, over the medium term, considering the multiplicity of channels of monetary policy transmission, the impact on other countries’ macroeconomic outlook is much less clear-cut. It also critically depends on the economic fundamentals of the receiving countries, as I will explain in more detail later.

The truth of the matter is that given the lack of historical precedents on what the impact of a major economy departing from a zero lower bound environment is, market analysts and policy makers do not have much of a choice other than “learning in real time”. While recent work in academia and policy institutions has improved our understanding of the transmission mechanisms that give rise to global spillovers, we still live with more open questions than answers.

In the remainder of my remarks, I would like to discuss the spillovers generated by monetary policy in the US and in the euro area in more detail. I shall also briefly touch upon the implications of a growth slowdown in emerging economies. I will then share my views on how policymakers can deal with these spillovers. Finally, I will briefly touch upon policies that may help increase the resilience of the international monetary system.

Monetary policy spillovers

International spillovers from the monetary policy of one country to other economies are a corollary of globalisation. This entails that we, as policymakers, have to rise to the challenge of conducting monetary policy in the presence of these unintended side-effects.

The sign and magnitude of monetary policy spillovers is, a priori, less clear than assumed in some economic debates. Consider, for example, the impact of a US dollar appreciation resulting from a tightening in US monetary policy. On the one hand, to the extent that the appreciation of the US dollar improves other economies’ price competitiveness, expenditure switching effects will shift US demand in favour of imported goods; at the same time, US goods become more expensive abroad, leading to substitution by domestic goods there. Through this expenditure switching channel, the spillovers from US monetary policy are expansionary for other countries. However, as the tightening in monetary policy leads to a dampening in US aggregate demand, contractionary spillovers will ensue through an overall import reduction in the US. As a result, the sign of the spillovers through trade is ambiguous. Recent research has emphasised that it depends on further complicating elements, such as the currency of trade invoicing. [3]

While a traditional textbook would focus on trade as the main channel of monetary policy spillovers, the literature suggests that financial channels – through exchange rates and capital flows – are more important, especially when departing from a stylised world with frictionless financial markets. In particular, in an international version of the financial accelerator with foreign-currency debt, a US dollar appreciation would increase the local-currency value of liabilities denominated in US dollar in the rest of the world. In turn, this would impair borrowers’ net-worth, at least in the absence of a matching cash-flow in US dollars. [4] This is the root of the classic “original sin” [5] in international macroeconomics, which can affect both public and private borrowers. The literature highlights a number of financial market imperfections that give rise to excessive volatility and contagion in asset prices and capital flows, magnifying the spillovers from monetary policy. [6] It is this multitude of transmission channels, some of them going in opposite directions, which calls for a cautious judgement of the sign and magnitude of the spillovers from monetary policy. With this in mind, let me now discuss the empirical evidence of monetary policy spillovers between the US, the euro area and emerging economies.

Spillovers from US monetary policy

Let me start with the international impact of US monetary policy. There is a broad consensus that the spillovers emanating from the US are relatively large. [7] This is rooted in the international role of the US dollars, both in global financial markets and in international trade. In particular, US monetary policy greatly affects risk premia, volatility of asset prices and global credit growth. It has even been argued that monetary policy in the US is the driver of a “global financial cycle”. According to this view, contractionary US monetary policy results in tighter financial conditions not only in the US but globally. [8]

The dominance of the US dollar in the invoicing of US trade makes spillovers from a US monetary policy tightening, contractionary. On the one hand, because more than 90% of US imports are invoiced in US dollar, US demand for foreign goods hardly rises in response to US monetary policy through expenditure switching effects. On the other hand, as the share of US exports invoiced in US dollars is 97%, an appreciation of the US dollar exchange rate may trigger expenditure switching in the rest of the world away from US towards domestic goods.

Overall, the spillovers from a tightening US monetary policy to output growth through expenditure switching are thus expansionary. In contrast, due to the stickiness of US dollar import prices, US demand for foreign goods closely co-moves with US aggregate demand, which contracts in response to the tightening in monetary policy. The dominance of the latter effect renders the output spillovers from a tightening US monetary policy through trade, contractionary. Furthermore, a high share of US exports invoiced in US dollar implies large spillovers to inflation abroad.

These spillovers from US monetary policy differ across countries and regions. For example, changes in the euro-US dollar exchange rate have a substantial impact on euro area export competitiveness towards third countries whose exchange rate is linked to the US dollar, given the prevalence of producer-currency pricing with a share of 70% among euro area exports. [9] US monetary policy therefore affects the euro area through the relative export competitiveness in the world markets and the competitiveness of US exports in the euro area. Import prices in the euro area are partly shielded from the effects of fluctuations in exchange rates in what concerns imports from countries other than the US, given that about 50% of aggregate euro area imports are invoiced in euro.

However, the central channel of spillovers from US monetary policy appears to be via capital markets. [10] In fact, US monetary policy has large financial spillovers, especially to European bond markets. German nominal bond yields, for example, follow the change of US bond yields in response to a US monetary policy tightening by more than one third. [11] Owing to the role of the US dollar in emerging economies’ integration with global financial markets, spillovers through valuation effects, “original sin” and financial accelerator mechanisms, are much stronger than in the euro area. Overall, the evidence even suggests that spillovers from US monetary policy might be larger than the domestic effects in the US. [12]

The spillovers from unconventional US monetary policy, such as the Federal Reserves’ asset purchases, are harder to quantify than those from conventional monetary policy. As there is not a single monitored policy variable, studies have to rely on indirect measures of unconventional monetary policy surprises. Typically, a quantity that monetary policy appears to target, such as corporate bond spreads or term premia, has been used to do so. One difficulty in interpreting the results of this strand of the literature stems from the possibility that interest rate spreads may reflect information that goes beyond what is captured by US monetary policy. As a second caveat, I would like to add that almost all unconventional monetary policy measures that were taken so far were expansionary. As available studies are necessarily based on past data, they might not be informative regarding the effects policy actions have in the opposite direction.

Spillovers from euro area monetary policy

Turning to the euro area, the evidence suggests that spillovers from euro area monetary policy are smaller than those from the US, not least because of the dominance of the US dollar in global financial markets. [13]

US inflation is shielded from exchange rate fluctuations in response to a euro area monetary policy loosening due to its “privileged insularity”, as almost all of US imports are invoiced in dollar. By the same token, euro area exports to the US would not benefit much from a depreciation of the euro vis-à-vis the dollar. At the same time, considering that a very large share of US exports to the euro area are invoiced in US dollar, there is a larger potential for real spillovers from euro area monetary policy to the US through expenditure switching away from US goods in the euro area. In this context, however, I would like to stress that if our monetary policy succeeds in stimulating euro area aggregate demand, then this will also increase euro area demand for US goods, counteracting the loss in competitiveness for US firms from the dollar appreciation. And as argued above, the income expenditure channel – in this case an expenditure increase – appear to be quantitatively more important than the expenditure switching channel.

As regards the spillovers from the euro area to emerging economies, given that about 70% of extra-euro area exports to these countries are invoiced in euro, there is a potential for a large impact through expenditure switching abroad. And due to the sheer size of the trade flows, such expenditure switching could have noticeable spillovers in neighbouring economies in Europe. In response to a euro area monetary policy loosening, this effect would be largely contractionary to the extent that their currencies appreciate vis-à-vis the euro. But again, any contractionary spillovers through expenditure-switching are likely to be undone by expansionary effects through the strengthening in euro area aggregate demand. And there is substantial empirical evidence that the latter dominate, in particular for neighbouring economies in Europe. [14]

More recently, some studies have suggested that spillovers from the euro area might have become larger, in particular those stemming from unconventional monetary policies and operating through financial channels. [15] Take the example of the ECB’s announcement of the Expanded Asset Purchase Program which triggered a concurrent decline in US bond yields, despite speculation about an imminent increase in the US Fed Funds rate. [16] The large size of foreign assets and liabilities in the US and the euro area implies that the balance sheet effects of an exchange rate or interest rate change can trigger larger spillovers from the euro area to the US than we had been used to.

A brief digression on emerging markets

Allow me a brief digression on emerging markets. The linkages between emerging and advanced economies are closely monitored at the present time. This is the case not only because of concerns over the impact of monetary policy decisions in advanced countries but also given that an economic slowdown in emerging economies may potentially compromise a still fragile global recovery. The lack of synchronisation between the business cycle and monetary policies in the US and the euro area may reduce the current impact of monetary policy decisions in advanced countries on emerging countries as the effects tend to offset each other. [17] The growth outlook in emerging economies may matter more than in the past. This is particularly evident if we consider that they account for more than 50% of world output, 40% of world trade volumes and an increasing, albeit still small, share of global stock market capitalisation or international bond issuance. [18] China is increasingly becoming a global player, whose decisions have increasingly relevant repercussions at the global level. Its share on global GDP has risen substantially, it accounts for a larger share of global trade, and is gradually liberalising its capital account and thereby integrating into global financial markets. Nevertheless, developments in China still have less direct impact on the euro area than those in the US. First, in 2014, the share of extra-euro area exports to the US in total exports was almost twice as large as the corresponding share accounted for by China. [19] Second, China’s demand for euro area exports is largely driven by global rather than by domestic demand. In particular, a large share of euro area exports to China is made up of intermediate goods, which are, in turn, used in the production of Chinese exports to the rest of the world. Third, due to the remaining restrictions on China’s capital account, financial integration between the euro area and China remains limited. In 2013, the share of US foreign financial assets held by euro area residents was more than 40 times as large as the corresponding share of Chinese foreign financial assets held by euro area residents. [20] And finally, a slowdown in China’s domestic demand lowers global commodity prices, which acts as a stimulus to commodity importers like the euro area. [21] Having said that, the ECB is carefully monitoring events in emerging economies, as their effect on the rest of the world might turn out to be larger if mutually-reinforcing neighbourhood effects materialise. [22]

Coping with monetary policy spillovers

To cut a long story short, the global economy has become more vulnerable than ever before to very large real and financial spillovers. Global factors drive asset prices and cross-border flows. And in some cases, the ability of domestic monetary policy to achieve its mandate might be more limited than we used to think, in particular in emerging economies. What measures should be taken to manage the risks associated with the rise in global financial integration while not forsaking its benefits?

One influential view in policy circles, close to being the conventional wisdom until some time ago, is that “putting your own house in order” is the main and best line of defence against external influences. Another view, that is rapidly gaining ground, surmises instead that global problems also require global solutions.

The first view seems to find some support in the fact that while recent bouts of financial market volatility typically occurred in response to global shocks, not all economies were affected to the same extent. This is consistent with evidence suggesting that global push factors explain capital surges in general but domestic pull factors determine in which country they end up. [23] Unfortunately, the debate about precisely which fundamentals mitigate economies’ vulnerability to abrupt capital flows episodes is not settled. Some studies find that emerging economies with better institutions were less affected by unconventional monetary policy measures in advanced economies, for example. Other evidence suggests that countries that had allowed their current accounts to run into large deficits and their exchange rates to substantively appreciate displayed larger capital flow volatility during the taper talk in 2013. And one study that will be presented at the conference finds that emerging economies, that were less vulnerable across a range of fundamentals, displayed a less pronounced deterioration of financial conditions during the taper tantrum. [24] At the same time, a number of papers fail to confirm these findings concerning the relevance of fundamentals for mitigating spillovers. [25]

Nevertheless, it is good news that many emerging economies have reduced their vulnerability along a number of dimensions, including having reduced current account deficits and adopted more flexible exchange rates. However, there remain worrisome pockets of vulnerability. The latter includes the level of corporate indebtedness and high stocks of foreign-currency debt in a number of emerging economies. [26] A deterioration in the global growth outlook combined with over-leveraged borrowers might pose significant challenges and non-trivial policy trade-offs for monetary policy.

The second view, pointing to the need for global solutions, rests its case on a growing strand in the literature that argues that financial conditions around the world are driven by a global financial cycle in risk appetite, the leverage of global banks and capital flows. A particular role in the transmission of this financial cycle across the world is assumed by global banks and international bond issuance more recently, as also highlighted by two papers that will be presented at the conference. [27] As already mentioned, US monetary policy is argued to have a substantial influence on the global financial cycle. [28] According to this increasingly popular view, a striking policy implication of the global financial cycle is that individual countries, especially emerging economies, face much starker trade-offs than those arising from the classic trilemma in international macroeconomics – the “impossible trinity” (a hypothesis that is also discussed by one of the papers that will be presented at the conference). [29] The predicament of many economies would in fact be better described by a dilemma between imposing capital controls on the one hand and forsaking domestic stabilisation on the other.

The debate about the dominance of the global financial cycle has re-ignited an old debate on the use of capital controls. In particular, a wave of theoretical work has emerged – one of these papers will be presented at the conference [30] – that rationalises the use of capital account restrictions as the welfare-optimising policy in a context in which large global shocks to capital flows lead to over-borrowing and financial vulnerability due to financial frictions. [31] This work has also contributed to the IMF’s revision of its view on capital flow management. [32] However, it is important to stress that the unilateral imposition of capital account restrictions can itself result in spillovers and externalities, in a suboptimal race to shift the burden of adjustment to global shocks from one country to others. [33]

Global responses

One might argue that the importance of common factors in global financial markets and the imperfect ability to shield the domestic economy against their impact implies a case for international policy co-ordination. [34] However, there are good reasons why binding forms of such co-ordination are difficult to implement in practice in the case of monetary policy.

In particular, each central bank draws its legitimacy from a domestic political process. Each central bank operates within its own specific circumstances, which include its own institutional set-up, mandate and economic/financial market environment. Reaching a common understanding on what the issues are, the policy responses and the gains from engagement, in view of the great uncertainties on how the global economy operates, would be a major challenge. Central banks clearly need to continue their dialogue and remain ready for swift co-ordinated action in exceptional circumstances. Central banks play an important role in helping stabilise the global financial system. In the aftermath of the global financial crisis, central banks were swift in extending swap lines to countries in need, on a discretionary basis. Our efforts contributing to the stabilisation have evolved into a standing swap facility among six major central banks. This contributes to stabilisation in a globalised world economy while respecting the mandates and independence of central banks.

It would be a mistake, however, to believe that central banks can solve all problems. Central bank actions aim at providing liquidity, ensuring the proper transmission of monetary policy and contributing to financial stability. They are not aimed at providing balance of payment support or at preserving the solvency of a state. This is a remit where I see much more scope for international co-ordination. But a global system of safety nets must also preserve the incentives to pursue responsible domestic policies and ensure prudent financial market behaviour to avoid a crisis in the first place. Safety nets should be designed so that they do not encourage moral hazard and excessive risk taking.

Clearly, we need to make the global financial system more resilient. At the global level, the biggest innovation over the past few years has perhaps been the introduction of specific precautionary arrangements, the Flexible Credit Line and the Precautionary Liquidity Line by the IMF. [35] There have been, however, other major improvements in the global financial safety net. In Europe, we now have a fully operational European Stability Mechanism to help countries in need. There is now also a Single Resolution Fund to support the resolution of banks that will be progressively fully financed by the banking industry. These are important steps ahead and Europe is not alone in improving its safety net. The Chiang Mai Initiative Multilateralisation (CMIM) in East Asia has doubled in size to USD 240bn. And in July this year, the BRICs launched a Contingent Reserve Arrangement among themselves to the tune of USD 100bn. Furthermore, there has been progress in the inclusion of enhanced Collective Auction Clauses into newly issued international sovereign bonds to reduce the disruptiveness of sovereign debt restructuring.

Nevertheless, with huge amounts of debt in US dollars being created around the world without liquidity backstops, we are still far from having a global lender of last resort adequate for our times. Without properly addressing this issue at the global level, we run the risk of a durable fragmentation of the international system.

Conclusion

Let me conclude. Global challenges require both domestic and global responses to ensure that the global financial system becomes more resilient. Important steps in the right direction have recently been taken on both fronts, albeit admittedly, many of these innovations have not yet been fully tested. We should not be complacent. In many ways, the present challenges to the global economy place the monetary and financial system at a sort of crossroads. We should not underestimate the challenges of living in the ever more closely interconnected global economy.

I thank you for your attention.

References

Ahmed Shaghil, Stephanie E. Curcuru, Francis Warnock and Andrei Zlate, 2015, presented at the conference “Divergent Monetary Policies, Global Capital flows and Financial Stability”, Hong Kong 15 October 2015.

Aizenman, Joshua, Mahir Binici and Michael M. Hutchison, 2014: “The Transmission of Federal Reserve Tapering News to Emerging Financial Markets”, NBER Working Paper, no. 19980.

Bank for International Settlements, 2015: “BIS Quarterly Review - International banking and financial market developments”, March.

Banerjee, Ryan, Michael Devereux and Giovanni Lombardo, 2015: “Self-Oriented Monetary Policy, Global Financial Markets and Excess Volatility of International Capital Flows”, mimeo.

Bekaert, Geert, Marie Hoerova and Marco Lo Duca, 2013: “Risk, Uncertainty and Monetary policy,” Journal of Monetary Economics 60(7), 771-788.

Bernanke, Ben S. and Mark Gertler, 1995: “Inside the Black Box: The Credit Channel of Monetary Policy Transmission.” Journal of Economic Perspectives 9(4), 27-48.

Borio, Claudio and Haibin Zhu, 2012: “Capital Regulation, Risk-Taking and Monetary Policy: A Missing Link in the Transmission Mechanism?” Journal of Financial Stability 8(4), 236-251.

Brunnermeier, Markus K. and Yuliy Sannikov, 2015: “International Credit Flows and Pecuniary Externalities,” American Economic Journal: Macroeconomics 7(1), 297-338.

Bruno, Valentina and Hyun Song Shin, 2015a: “Capital Flows and the Risk-Taking Channel of Monetary Policy”, Journal of Monetary Economics 71, 119–132.

Bruno, Valentina and Hyun Song Shin, 2015b: “Cross-Border Banking and Global Liquidity”, Review of Economic Studies, Oxford University Press, 82(2), 535-564.

Buitron, Carolina O. and Esteban Vesperoni, 2015: “Spillover Implications of Differences in Monetary Conditions in the United States and the Euro Area”, International Monetary Fund, 2015.

Canova, Fabio, 2005: “The Transmission of US shocks to Latin America," Journal of Applied Econometrics 20(2), 229-251.

Cerutti, Eugenio, Stijn Claessens and Damien Puy, 2015: Push Factors and Capital Flows to Emerging Markets: Why Knowing your Lender Matters, VOX CEPR.

Cetorelli, Nicola and Linda S. Goldberg, 2012: “Banking Globalization and Monetary Transmission”, Journal of Finance, American Finance Association, 67(5), 1811-1843.

Chen, Qianying, Andrew Filardo, Dong He and Feng Zhu, 2015: “Financial Crisis, US Unconventional Monetary Policy and International Spillovers”, BIS Working Paper 494.

Davis, Scott and Ignacio Presno, 2015: “Capital Controls and Monetary Policy Autonomy in a Small Open Economy” presented at the conference “Divergent Monetary Policies, Global Capital flows and Financial Stability”, Hong Kong 15 October 2015.

ECB, 2015a, Economic Bulletin Issue 6, Box 5.

ECB, 2015b: “The International Role of the Euro”, European Central Bank, July.

Ehrmann, Michael and Marcel Fratzscher, 2003. “Interdependence between the Euro Area and the U.S.: what Role for EMU?”, Proceedings, Board of Governors of the Federal Reserve System.

Ehrmann, Michael and Marcel Fratzscher, 2005: “Equal Size, Equal Role? Interest Rate Interdependence between the Euro Area and the United States”, Economic Journal 115 (506), 928-948.

Ehrmann, Michael and Marcel Fratzscher and Roberto Rigobon, 2011: “Stocks, Bonds, Money Markets and Exchange Rates: Measuring International Financial Transmission”, Journal of Applied Econometrics 26(6), 948-974.

Eichengreen, Barry and Poonam Gupta, 2014: “Tapering Talk: The Impact of Expectations of Reduced Federal Reserve Security Purchases on Emerging Markets," MPRA Paper 53040, University Library of Munich, Germany.

Eichengreen, Barry, Ricardo Hausmann, and Ugo Panizza, 2005: “The Pain of Original Sin” in: Barry Eichengreen und Ricardo Hausmann (eds): Other People’s Money – Debt Denomination and Financial Instability in Emerging Market Economies. Chicago University Press, 13-37.

Errit, Gertrud and Lenno Uusküla, 2014: “Euro area monetary policy transmission in Estonia,” Baltic Journal of Economics 14(1-2), 55-77.

Falagiarda, Matteo, Peter McQuade and Marcel Tirpák, 2015: “Spillovers From the ECB’s Non-Standard Monetary Policies on Non-Euro area EU countries: Evidence from an Event-Study Analysis”, ECB Working Paper Series (forthcoming).

Fischer, Stanley, 1999: “On the Need for an International Lender of Last Resort.” Journal of Economic Perspectives, 13(4), 85-104.

Forbes, Kristin, 2012: “The “Big C”: Identifying and Mitigating Contagion”, Proceedings - Economic Policy Symposium - Jackson Hole, Federal Reserve Bank of Kansas City, 23-87.

Forbes, Kristin, 2014: “Turmoil in Emerging Markets: What’s Missing from the Story?”, VOX CEPR.

Forbes, Kristin and Francis Warnock, 2012: “Capital Flow Waves: Surges, Stops, Flight and Retrenchment”, Journal of International Economics 88(2), 235-51.

Forbes, Kristin, Marcel Fratzscher, Thomas Kostka and Roland Straub, 2012: “Bubble Thy Neighbor: Portfolio Effects and Externalities from Capital Controls”, NBER Working Paper, no. 18052.

Fratzscher, Marcel, Marco Lo Duca and Ronald Straub, 2013: “On the International Spillovers of US Quantitative Easing”, ECB Working Paper 1557.

Fratzscher, Marcel, Marco Lo Duca and Roland Straub, 2014: “ECB Unconventional Monetary Policy Actions: Market Impact, International Spillovers and Transmission Channels,” Paper presented at the 15th Jacques Polak Annual Research Conference.

Georgiadis, Georgios, 2015: “Determinants of Global Spillovers from US Monetary Policy”, Journal of International Money and Finance, forthcoming.

Georgiadis, Georgios and Johannes Gräb, 2015: “Global Financial Market Impact of the Announcement of the ECB's Extended Asset Purchase Programme,” Globalization and Monetary Policy Institute Working Paper 232, Federal Reserve Bank of Dallas.

Georgiadis, Georgios and Arnaud Mehl, 2015: “Trilemma, not Dilemma: Financial Globalisation and Monetary Policy Effectiveness”, Globalization and Monetary Policy Institute Working Paper 222, Federal Reserve Bank of Dallas.

Gertler, Mark, Simon Gilchrist and Fabio M. Natalucci, 2007: “External Constraints on Monetary Policy and the Financial Accelerator”, Journal of Money, Credit and Banking 39 (2-3), 295-330.

Gertler, Mark and Nobuhiro Kiyotaki, 2015: “Banking, Liquidity, and Bank Runs in an Infinite Horizon Economy”, American Economic Review 105(7), 2011-2043.

Giannone, Domenico, Michele Lenza and Lucrezia Reichlin, 2012: "Money, Credit, Monetary Policy and the Business Cycle in the Euro Area”, CEPR Discussion Paper 8944.

Glick, Reuven and Sylvain Leduc, 2012: “Central Bank Announcements of Asset Purchases and the Impact on Global Financial and Commodity Markets”, Journal of International Money and Finance 31(8), December, 2078-2101.

Gopinath, Gita, 2015: “The International Price System”, Federal Reserve Bank of Kansas City Economic Policy Symposium.

Ghosh, Atish R., Mahvash S. Qureshi, Jun Il Kim and Juan Zalduendo, 2014: “Surges”, Journal of International Economics, 92, 266-285.

Haldane, Andrew G., 2014: “Managing Global Finance as a System”, speech delivered at the Maxwell Fry Annual Global Finance Lecture, Birmingham University, 29 October 2014.

Haldane, Andrew G., 2015: “How Low can You Go?”, speech delivered at the Portadown Chamber of Commerce, 18 September 2015.

He, Dong, Eric Wong, Andrew Tsang and Kelvin Ho, 2015: “Asynchronous Monetary Policies and International Dollar Credit”, Working Papers 192015, Hong Kong Institute for Monetary Research.

IMF, Spillover Reports, 2012, 2013 and 2014 issues.

IMF, 2013b: Dancing Together? Spillovers, Common Shocks, and the Role of Financial and Trade Linkages, World Economic Outlook, Chapter 3

IMF, 2015: Global Financial Stability Report: Navigating Monetary Policy Challenges and Managing Risks. Washington.

Jannsen, Nils and Melanie Klein, 2011: “The International Transmission of Euro Area Monetary Policy Shocks,” Kiel Working Papers 1718, Kiel Institute for the World Economy.

Jeanne, Olivier and Anton Korinek, 2013: “Macroprudential Regulation Versus Mopping Up After the Crash”, NBER Working Paper, no. 18675.

Kim, Soyoung, 2001: “International Transmission of U.S. Monetary Policy Shocks: Evidence from VAR's”, Journal of Monetary Economics 48(2), 339–372.

Kim, Soyoung and Shin Hyun Song Shin, 2015: “Transmission Channels of Global Liquidity” presented at the conference “Divergent Monetary Policies, Global Capital flows and Financial Stability”, Hong Kong 15 October 2015.

Kucharcukova, Oxana B., Peter Claeys and Borek Vasicek, 2014: "Spillover of the ECB's Monetary Policy Outside the Euro Area: How Different is Conventional From Unconventional Policy?," Working Papers 2014/15, Czech National Bank, Research Department.

Mackowiak, Bartosz, 2007: “External Shocks, U.S. Monetary Policy and Macroeconomic Fluctuations in Emerging Markets”, Journal of Monetary Economics 54(8), 2512-2520.

Mendoza, Enrique G. and Javier Bianchi, 2011: “Overborrowing, Financial Crises and Macro-prudential”, IMF Working Papers 11/24, International Monetary Fund.

Miranda-Agrippino, Silvia and Hélene Rey, 2014: “World Asset Markets and the Global Financial Cycle”, Technical Report, Working Paper, London Business School.

Moore, Jeffrey, Sunwoo Nam, Myeongguk Suh and Alexander Tepper, 2013: “Estimating the Impacts of the U.S. LSAPs on Emerging Market Economies’ Local Currency Bond Markets”, Federal Reserve Bank of New York Staff Report 595.

Neely, Christopher J., 2010: “The Large Scale Asset Purchases Had Large International Effects”, Working Papers 2010-018, Federal Reserve Bank of St. Louis.

Neely, Christopher J., 2015: “Unconventional Monetary Policy had Large International Effects”, Journal of Banking & Finance 52(C), 101-111.

Nobili Andrea and Stefano Neri, 2006. The Transmission of Monetary Policy Shocks from the US to the Euro Area”, Temi di Discussione, 606, Bank of Italy.

Ostry, Jonathan and Atish Ghosh, 2013: “Obstacles to International Policy Coordination, and How to Overcome Them”, IMF Staff Discussion Note 11.

Pitterle, Ingo, Fabio Haufler and Pingfan Hong, 2015: “Assessing Emerging Markets’ Vulnerability to Financial Crisis”, Journal of Policy Modeling 37(3), 484-500.

Rajan, Raghuram G., 2005: “Has Financial Development Made the World Riskier?”, Proceedings - Economic Policy Symposium - Jackson Hole, Federal Reserve Bank of Kansas City, August, 313-369.

Rajan, Raghuram G., 2013: “A Step in the Dark: Unconventional Monetary Policy after the Crisis”, Speech at The Andrew Crockett Memorial Lecture, BIS Basel.

Rey, Hélène, 2013: “Dilemma Not Trilemma: The Global Financial Cycle and Monetary Policy Independence”, Federal Reserve Bank of Kansas City Economic Policy Symposium.

Rey, Hélène, 2015: “International Credit Channel and Monetary Policy Autonomy”, Mundell Fleming Lecture (IMF), forthcoming IMF Economic Policy Review.

Rogers, John H., Chiara Scotti and Jonathan H. Wright, 2014: “Evaluating Asset-Market Effects of Unconventional Monetary Policy: a Multi-Country Review”, Economic Policy 29(80), 749-799.

[1]I wish to thank M. Ca’ Zorzi, G. Georgiadis, G. Strasser and L. Dedola, from the ECB staff for contributions in the preparation of this speech.

[2]Several event studies in the literature evaluate the domestic and global impact of monetary policy changes and announcement by controlling for changes in economic fundamentals and news (Neely, 2010; Fratzscher, Lo Duca and Straub, 2013, 2014; Moore et al. 2013 and Georgiadis and Gräb, 2015). However, my take on this is that they are better suited to gauge the short-term rather than the long-term global impacts of monetary policy, in particular because they have a hard time in estimating the persistence of announcement effects.

[3]See Gopinath (2015) and ECBb (2015).

[4]This balance sheet effect has been pioneered as part of the “credit channel” of monetary policy transmission by Bernanke and Gertler (1995). See Gertler, Gilchrist and Natalucci (2007) for an open-economy extension emphasizing private-sector foreign-currency debt.

[5]Eichengreen, Hausmann, and Panizza (2005).

[6]See e.g. Forbes (2012). Other channels include the “risk taking channel”, which rests on the effect of monetary policy on the risk appetite of market participants, as described by Bruno and Shin (2015a), and Rajan (2005).

[7]See Kim (2001), Canova (2005), Mackowiak (2007), Fratzscher, Lo Duca and Straub (2013), IMF (2012), Rogers, Scotti and Wright (2014) as well as Georgiadis (2015).

[8]See Cetorelli and Goldberg (2012), Bekaert, Hoerova and Lo Duca (2013), Miranda-Agrippino and Rey (2014), Rey (2013), as well as Bruno and Shin (2015b).

[9]The competitiveness of euro area exporters vis-à-vis US domestic producers changes less, because these exports are mostly denominated in US dollar and are thus subject to incomplete exchange rate pass-through.

[10]For example, Kim (2001) estimates that between one-fourth and one-half of the stimulus of an expansionary US monetary policy for US output growth spills over to the output of Germany, France, Italy, Japan and UK. This spillover operates mainly through the capital market, whereas the trade channel plays only a minor role. See also Canova (2005); Nobili and Neri (2006); IMF 2013b; Georgiadis (2015).

[11]Ehrmann and Fratzscher (2005) estimate that after 1999, about 1/3 of US Treasury bill rate changes feed through to euro area interbank rates. They find that US monetary policy has no significant impact on euro area beyond these indirect spillovers from US interest rates. Neely (2015) finds spillovers of a similar magnitude.

[12]See Canova (2005), Mackowiak (2007), Banerjee et al. (2015), Chen, Filardo, He and Zhu (2015), as well as Georgiadis (2015).

[13]See Rogers, Scotti, and Wright (2014), Ehrmann and Fratzscher (2003, 2005), Ehrmann, Fratzscher and Rigobon (2007), Fratzscher, Lo Duca and Straub (2014)

[14]See for example Jannsen and Klein (2011), Errit and Uusküla (2013), Falagiarda, McQuade and Tirpak (2015) as well as Kucharcukova, Claeys and Vasicek (2014).

[15]See Buitron and Vesperoni (2015) as well as IMF (2012, 2013, 2015).

[16]See Bank of International Settlements (2015).

[17]See He et al. (2015), Kim and Shin (2015) and Buitron and Vesperoni (2015).

[18]See Haldane (2015).

[19]12% versus 6.9% according to IMF Direction of Trade Statistics data. Notice that in order to account for competition faced by euro area companies in foreign markets from exporters based in third countries the weight of the renminbi in the euro effective exchange rate departs from the direct bilateral export linkages. In the case of China, the “double” export weight amounts to 16% compared to a direct export weight of 7%, over the period 2010-12 (see ECB Economic Bulletin 6, 2015).

[20]13% versus 0.3% according to IMF Coordinated Portfolio Investment Survey data.

[21]See IMF (2015).

[22]See IMF (2014).

[23]See Ghosh et al. (2014).

[24]Fratzscher, Lo Duca and Straub (2013), Eichengreen and Gupta (2014), Ahmed et al. (2015) as well as Chen et al. (2015).

[25]See Forbes and Warnock (2012), Forbes (2014), Cerutti et al. (2015), Aizenmann et al. (2014) and Eichengreen and Gupta (2014). Fratzscher, Lo Duca and Straub (2013) find no evidence consistent with the hypothesis that a flexible exchange rate regime or capital account restrictions helped economies to insulate from unconventional monetary policies abroad.

[26]See Pitterle et al. (2015).

[27]See He et al. (2015) as well as Kim and Shin (2014).

[28]See Cetorelli and Goldberg (2012), Bekaert, Hoerova and Lo Duca (2013), Miranda-Agrippino and Rey, (2014) and Bruno and Shin (2015b).

[29]See Georgiadis and Mehl (2015), Rey (2013) and Rey (2015).

[30]Davis and Presno (2015).

[31]See Jeanne and Korinek (2013), Mendoza and Bianchi (2011) and Brunnermeier and Sannikov (2015).

[32]See IMF (2012) as well as Ostry and Ghosh (2013).

[33]See Forbes et al. (2012).

[34]See Rajan (2013) and Ostry and Ghosh (2013).

[35] See Haldane (2014) and Fischer (1999).

Source: ECB website

Comentarii

Adauga un comentariu

Adauga un comentariu folosind contul de Facebook

Alte stiri din categoria: Noutati BCE

Banca Centrala Europeana (BCE) explica de ce a majorat dobanda la 2%

Banca Centrala Europeana (BCE) explica de ce a majorat dobanda la 2%, in cadrul unei conferinte de presa sustinute de Christine Lagarde, președinta BCE, si Luis de Guindos, vicepreședintele BCE. Iata textul publicat de BCE: DECLARAȚIE DE POLITICĂ MONETARĂ detalii

BCE creste dobanda la 2%, dupa ce inflatia a ajuns la 10%

Banca Centrala Europeana (BCE) a majorat dobanda de referinta pentru tarile din zona euro cu 0,75 puncte, la 2% pe an, din cauza cresterii substantiale a inflatiei, ajunsa la aproape 10% in septembrie, cu mult peste tinta BCE, de doar 2%. In aceste conditii, BCE a anuntat ca va continua sa majoreze dobanda de politica monetara. De asemenea, BCE a luat masuri pentru a reduce nivelul imprumuturilor acordate bancilor in perioada pandemiei coronavirusului, prin majorarea dobanzii aferente acestor facilitati, denumite operațiuni țintite de refinanțare pe termen mai lung (OTRTL). Comunicatul BCE Consiliul guvernatorilor a decis astăzi să majoreze cu 75 puncte de bază cele trei rate ale dobânzilor detalii

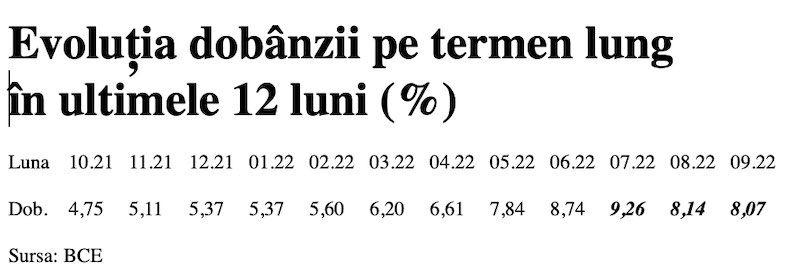

Dobânda pe termen lung a continuat să scadă in septembrie 2022. Ecartul față de Polonia și Cehia, redus semnificativ

Dobânda pe termen lung pentru România a scăzut în septembrie 2022 la valoarea medie de 8,07%, potrivit datelor publicate de Banca Centrală Europeană. Acest indicator, cu referința la un termen de 10 ani (10Y), a continuat astfel tendința detalii

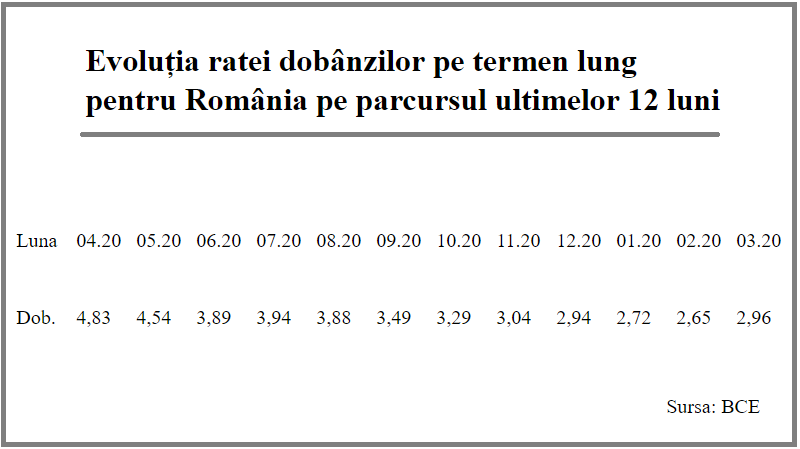

Rata dobanzii pe termen lung pentru Romania, in crestere la 2,96%

Rata dobânzii pe termen lung pentru România a crescut la 2,96% în luna martie 2021, de la 2,65% în luna precedentă, potrivit datelor publicate de Banca Centrală Europeană. Acest indicator critic pentru plățile la datoria externă scăzuse anterior timp de șapte luni detalii

- BCE recomanda bancilor sa nu plateasca dividende

- Modul de functionare a relaxarii cantitative (quantitative easing – QE)

- Dobanda la euro nu va creste pana in iunie 2020

- BCE trebuie sa fie consultata inainte de adoptarea de legi care afecteaza bancile nationale

- BCE a publicat avizul privind taxa bancara

- BCE va mentine la 0% dobanda de referinta pentru euro cel putin pana la finalul lui 2019

- ECB: Insights into the digital transformation of the retail payments ecosystem

- ECB introductory statement on Governing Council decisions

- Speech by Mario Draghi, President of the ECB: Sustaining openness in a dynamic global economy

- Deciziile de politica monetara ale BCE

Criza COVID-19

- In majoritatea unitatilor BRD se poate intra fara certificat verde

- La BCR se poate intra fara certificat verde

- Firmele, obligate sa dea zile libere parintilor care stau cu copiii in timpul pandemiei de coronavirus

- CEC Bank: accesul in banca se face fara certificat verde

- Cum se amana ratele la creditele Garanti BBVA

Topuri Banci

- Topul bancilor dupa active si cota de piata in perioada 2022-2015

- Topul bancilor cu cele mai mici dobanzi la creditele de nevoi personale

- Topul bancilor la active in 2019

- Topul celor mai mari banci din Romania dupa valoarea activelor in 2018

- Topul bancilor dupa active in 2017

Asociatia Romana a Bancilor (ARB)

- Băncile din România nu au majorat comisioanele aferente operațiunilor în numerar

- Concurs de educatie financiara pentru elevi, cu premii in bani

- Creditele acordate de banci au crescut cu 14% in 2022

- Romanii stiu educatie financiara de nota 7

- Gradul de incluziune financiara in Romania a ajuns la aproape 70%

ROBOR

- ROBOR: ce este, cum se calculeaza, ce il influenteaza, explicat de Asociatia Pietelor Financiare

- ROBOR a scazut la 1,59%, dupa ce BNR a redus dobanda la 1,25%

- Dobanzile variabile la creditele noi in lei nu scad, pentru ca IRCC ramane aproape neschimbat, la 2,4%, desi ROBOR s-a micsorat cu un punct, la 2,2%

- IRCC, indicele de dobanda pentru creditele in lei ale persoanelor fizice, a scazut la 1,75%, dar nu va avea efecte imediate pe piata creditarii

- Istoricul ROBOR la 3 luni, in perioada 01.08.1995 - 31.12.2019

Taxa bancara

- Normele metodologice pentru aplicarea taxei bancare, publicate de Ministerul Finantelor

- Noul ROBOR se va aplica automat la creditele noi si prin refinantare la cele in derulare

- Taxa bancara ar putea fi redusa de la 1,2% la 0,4% la bancile mari si 0,2% la cele mici, insa bancherii avertizeaza ca indiferent de nivelul acesteia, intermedierea financiara va scadea iar dobanzile vor creste

- Raiffeisen anunta ca activitatea bancii a incetinit substantial din cauza taxei bancare; strategia va fi reevaluata, nu vor mai fi acordate credite cu dobanzi mici

- Tariceanu anunta un acord de principiu privind taxa bancara: ROBOR-ul ar putea fi inlocuit cu marja de dobanda a bancilor

Statistici BNR

- Deficitul contului curent, aproape 20 miliarde euro după primele nouă luni

- Deficitul contului curent, aproape 18 miliarde euro după primele opt luni

- Deficitul contului curent, peste 9 miliarde euro pe primele cinci luni

- Deficitul contului curent, 6,6 miliarde euro după prima treime a anului

- Deficitul contului curent pe T1, aproape 4 miliarde euro

Legislatie

- Legea nr. 311/2015 privind schemele de garantare a depozitelor şi Fondul de garantare a depozitelor bancare

- Rambursarea anticipata a unui credit, conform OUG 50/2010

- OUG nr.21 din 1992 privind protectia consumatorului, actualizata

- Legea nr. 190 din 1999 privind creditul ipotecar pentru investiții imobiliare

- Reguli privind stabilirea ratelor de referinţă ROBID şi ROBOR

Lege plafonare dobanzi credite

- BNR propune Parlamentului plafonarea dobanzilor la creditele bancilor intre 1,5 si 4 ori peste DAE medie, in functie de tipul creditului; in cazul IFN-urilor, plafonarea dobanzilor nu se justifica

- Legile privind plafonarea dobanzilor la credite si a datoriilor preluate de firmele de recuperare se discuta in Parlament (actualizat)

- Legea privind plafonarea dobanzilor la credite nu a fost inclusa pe ordinea de zi a comisiilor din Camera Deputatilor

- Senatorul Zamfir, despre plafonarea dobanzilor la credite: numai bou-i consecvent!

- Parlamentul dezbate marti legile de plafonare a dobanzilor la credite si a datoriilor cesionate de banci firmelor de recuperare (actualizat)

Anunturi banci

- Cate reclamatii primeste Intesa Sanpaolo Bank si cum le gestioneaza

- Platile instant, posibile la 13 banci

- Aplicatia CEC app va functiona doar pe telefoane cu Android minim 8 sau iOS minim 12

- Bancile comunica automat cu ANAF situatia popririlor

- BRD bate recordul la credite de consum, in ciuda dobanzilor mari, si obtine un profit ridicat

Analize economice

- România, „lanterna roșie” a cheltuielilor pentru cercetare-dezvoltare în UE

- Deficitul contului curent, peste 24 miliarde euro după primele zece luni

- Deficit comercial record în octombrie 2024

- Productivitatea în comerț, peste cea din industrie

- -6,2% din PIB, deficit bugetar după zece luni

Ministerul Finantelor

- Datoria publică, 51,4% din PIB la mijlocul anului

- Deficit bugetar de 3,6% din PIB după prima jumătate a anului

- Deficit bugetar de 3,4% din PIB după primele cinci luni ale anului

- Deficit bugetar îngrijorător după prima treime a anului

- Deficitul bugetar, -2,06% din PIB pe primul trimestru al anului

Biroul de Credit

- FUNDAMENTAREA LEGALITATII PRELUCRARII DATELOR PERSONALE IN SISTEMUL BIROULUI DE CREDIT

- BCR: prelucrarea datelor personale la Biroul de Credit

- Care banci si IFN-uri raporteaza clientii la Biroul de Credit

- Ce trebuie sa stim despre Biroul de Credit

- Care este procedura BCR de raportare a clientilor la Biroul de Credit

Procese

- ANPC pierde un proces cu Intesa si ARB privind modul de calcul al ratelor la credite

- Un client Credius obtine in justitie anularea creditului, din cauza dobanzii prea mari

- Hotararea judecatoriei prin care Aedificium, fosta Raiffeisen Banca pentru Locuinte, si statul sunt obligati sa achite unui client prima de stat

- Decizia Curtii de Apel Bucuresti in procesul dintre Raiffeisen Banca pentru Locuinte si Curtea de Conturi

- Vodafone, obligata de judecatori sa despagubeasca un abonat caruia a refuzat sa-i repare un telefon stricat sau sa-i dea banii inapoi (decizia instantei)

Stiri economice

- Inflația anuală a crescut la 5,11%, prin efect de bază

- Datoria publică, 54,4% din PIB la finele lunii septembrie 2024

- România, tot prima dar în trendul UE la inflația anuală

- Datoria publică, 52,7% din PIB la finele lunii august 2024

- -5,44% din PIB, deficit bugetar înaintea ultimului trimestru din 2024

Statistici

- România, pe locul trei în UE la creșterea costului muncii în T2 2024

- Cheltuielile cu pensiile - România, pe locul 19 în UE ca pondere în PIB

- Dobanda din Cehia a crescut cu 7 puncte intr-un singur an

- Care este valoarea salariului minim brut si net pe economie in 2024?

- Cat va fi salariul brut si net in Romania in 2024, 2025, 2026 si 2027, conform prognozei oficiale

FNGCIMM

- Programul IMM Invest continua si in 2021

- Garantiile de stat pentru credite acordate de FNGCIMM au crescut cu 185% in 2020

- Programul IMM invest se prelungeste pana in 30 iunie 2021

- Firmele pot obtine credite bancare garantate si subventionate de stat, pe baza facturilor (factoring), prin programul IMM Factor

- Programul IMM Leasing va fi operational in perioada urmatoare, anunta FNGCIMM

Calculator de credite

- ROBOR la 3 luni a scazut cu aproape un punct, dupa masurile luate de BNR; cu cat se reduce rata la credite?

- In ce mall din sectorul 4 pot face o simulare pentru o refinantare?

Noutati BCE

- Acord intre BCE si BNR pentru supravegherea bancilor

- Banca Centrala Europeana (BCE) explica de ce a majorat dobanda la 2%

- BCE creste dobanda la 2%, dupa ce inflatia a ajuns la 10%

- Dobânda pe termen lung a continuat să scadă in septembrie 2022. Ecartul față de Polonia și Cehia, redus semnificativ

- Rata dobanzii pe termen lung pentru Romania, in crestere la 2,96%

Noutati EBA

- Bancile romanesti detin cele mai multe titluri de stat din Europa

- Guidelines on legislative and non-legislative moratoria on loan repayments applied in the light of the COVID-19 crisis

- The EBA reactivates its Guidelines on legislative and non-legislative moratoria

- EBA publishes 2018 EU-wide stress test results

- EBA launches 2018 EU-wide transparency exercise

Noutati FGDB

- Banii din banci sunt garantati, anunta FGDB

- Depozitele bancare garantate de FGDB au crescut cu 13 miliarde lei

- Depozitele bancare garantate de FGDB reprezinta doua treimi din totalul depozitelor din bancile romanesti

- Peste 80% din depozitele bancare sunt garantate

- Depozitele bancare nu intra in campania electorala

CSALB

- Sistemul bancar romanesc este deosebit de bine pregatit pentru orice fel de socuri

- La CSALB poti castiga un litigiu cu banca pe care l-ai pierde in instanta

- Negocierile dintre banci si clienti la CSALB, in crestere cu 30%

- Sondaj: dobanda fixa la credite, considerata mai buna decat cea variabila, desi este mai mare

- CSALB: Romanii cu credite caută soluții pentru reducerea ratelor. Cum raspund bancile

First Bank

- Ce trebuie sa faca cei care au asigurare la credit emisa de Euroins

- First Bank este reprezentanta Eurobank in Romania: ce se intampla cu creditele Bancpost?

- Clientii First Bank pot face plati prin Google Pay

- First Bank anunta rezultatele financiare din prima jumatate a anului 2021

- First Bank are o noua aplicatie de mobile banking

Noutati FMI

- FMI: criza COVID-19 se transforma in criza economica si financiara in 2020, suntem pregatiti cu 1 trilion (o mie de miliarde) de dolari, pentru a ajuta tarile in dificultate; prioritatea sunt ajutoarele financiare pentru familiile si firmele vulnerabile

- FMI cere BNR sa intareasca politica monetara iar Guvernului sa modifice legea pensiilor

- FMI: majorarea salariilor din sectorul public si legea pensiilor ar trebui reevaluate

- IMF statement of the 2018 Article IV Mission to Romania

- Jaewoo Lee, new IMF mission chief for Romania and Bulgaria

Noutati BERD

- Creditele neperformante (npl) - statistici BERD

- BERD este ingrijorata de investigatia autoritatilor din Republica Moldova la Victoria Bank, subsidiara Bancii Transilvania

- BERD dezvaluie cat a platit pe actiunile Piraeus Bank

- ING Bank si BERD finanteaza parcul logistic CTPark Bucharest

- EBRD hails Moldova banking breakthrough

Noutati Federal Reserve

- Federal Reserve anunta noi masuri extinse pentru combaterea crizei COVID-19, care produce pagube "imense" in Statele Unite si in lume

- Federal Reserve urca dobanda la 2,25%

- Federal Reserve decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent

- Federal Reserve majoreaza dobanda de referinta pentru dolar la 1,5% - 1,75%

- Federal Reserve issues FOMC statement

Noutati BEI

- BEI a redus cu 31% sprijinul acordat Romaniei in 2018

- Romania implements SME Initiative: EUR 580 m for Romanian businesses

- European Investment Bank (EIB) is lending EUR 20 million to Agricover Credit IFN

Mobile banking

- Comisioanele BRD pentru MyBRD Mobile, MyBRD Net, My BRD SMS

- Termeni si conditii contractuale ale serviciului You BRD

- Recomandari de securitate ale BRD pentru utilizatorii de internet/mobile banking

- CEC Bank - Ghid utilizare token sub forma de card bancar

- Cinci banci permit platile cu telefonul mobil prin Google Pay

Noutati Comisia Europeana

- Avertismentul Comitetului European pentru risc sistemic (CERS) privind vulnerabilitățile din sistemul financiar al Uniunii

- Cele mai mici preturi din Europa sunt in Romania

- State aid: Commission refers Romania to Court for failure to recover illegal aid worth up to €92 million

- Comisia Europeana publica raportul privind progresele inregistrate de Romania in cadrul mecanismului de cooperare si de verificare (MCV)

- Infringements: Commission refers Greece, Ireland and Romania to the Court of Justice for not implementing anti-money laundering rules

Noutati BVB

- BET AeRO, primul indice pentru piata AeRO, la BVB

- Laptaria cu Caimac s-a listat pe piata AeRO a BVB

- Banca Transilvania plateste un dividend brut pe actiune de 0,17 lei din profitul pe 2018

- Obligatiunile Bancii Transilvania se tranzactioneaza la Bursa de Valori Bucuresti

- Obligatiunile Good Pople SA (FRU21) au debutat pe piata AeRO

Institutul National de Statistica

- Comerțul cu amănuntul - în creștere cu 8% pe primele 10 luni

- Deficitul balanței comerciale la 9 luni, cu 15% mai mare față de aceeași perioadă a anului trecut

- Producția industrială, în scădere semnificativă

- Pensia reală, în creștere cu 8,7% pe luna august 2024

- Avansul PIB pe T1 2024, majorat la +0,5%

Informatii utile asigurari

- Data de la care FGA face plati pentru asigurarile RCA Euroins: 17 mai 2023

- Asigurarea împotriva dezastrelor, valabilă și in caz de faliment

- Asiguratii nu au nevoie de documente de confirmare a cutremurului

- Cum functioneaza o asigurare de viata Metropolitan pentru un credit la Banca Transilvania?

- Care sunt documente necesare pentru dosarul de dauna la Cardif?

ING Bank

- La ING se vor putea face plati instant din decembrie 2022

- Cum evitam tentativele de frauda online?

- Clientii ING Bank trebuie sa-si actualizeze aplicatia Home Bank pana in 20 martie

- Obligatiunile Rockcastle, cel mai mare proprietar de centre comerciale din Europa Centrala si de Est, intermediata de ING Bank

- ING Bank transforma departamentul de responsabilitate sociala intr-unul de sustenabilitate

Ultimele Comentarii

-

împrumut

Vreau să apreciez pe Karin Sabine un împrumut de 9000€ pentru mine. Dacă aveți nevoie de un ... detalii

-

împrumut

Vreau să apreciez pe Karin Sabine un împrumut de 9000€ pentru mine. Dacă aveți nevoie de un ... detalii

-

Buna ziua! Am nevoie de ajutor!

Buna ziua! Am trimis activare cont si imi scrie ca au expediat QR Cod pe posta dar nu mia venit ... detalii

-

Înșelătorie

Mare atenție la firma vex group, te pune să investești 250 € în Forex, câștigi ceva și ... detalii

-

interdictie conturi ING

Buna ziua, o situatie ca cele de mai sus am patit si eu, cu diferenta ca Revolut a deblocat contul ... detalii