Jean-Claude Trichet: Interview with Aachener Zeitung on the occasion of the awarding of the 2011 International Charlemagne Prize of Aachen

Autor: Bancherul.ro

Autor: Bancherul.ro

2011-06-01 14:13

Interview with Aachener Zeitung on the occasion of the awarding of the 2011 International Charlemagne Prize of Aachen

Interview with Jean-Claude Trichet, President of the ECB,

conducted by Ms Birgit Marschall, Mr Bernd Mathieu and Mr Peter Pappert of the Aachener Zeitung,

27 May 2011

Question: Mr President, people in Europe are worried about the debt crisis in the euro area. What is your take on the current situation?

Trichet: We are experiencing a dramatic global financial crisis, which is also impacting on the euro area. This is the deepest recession since the Second World War. All the advanced economies – the United States, Japan and Europe – must draw lessons from it. The outlook for the monetary union is favourable: the euro and prices are stable. The average inflation rate in the euro countries over the last 12 years has been just under 2%, and in Germany it has been as low as 1.5%; this is a better result than was achieved during the 50 years of the Deutsche Mark.

Question: So where does the problem lie?

Trichet: The real problem in the euro area is that the economic union – the “E” in EMU –between the euro countries has not been properly implemented. There is a need for much improvement on that score. The most important lesson from the crisis is that the euro countries must coordinate their economic and financial policies better – and do so urgently.

Question: We are a long way from there, look at Greece.

Trichet: In recent years the EU governments have ignored the rules of the Stability and Growth Pact. Unfortunately the large countries – i.e. France, Germany and Italy – tried to weaken the Stability and Growth Pact or even rescind it in 2004 and 2005, when they themselves were not complying with it. I expressed grave concerns at the time, because the letter of the Pact was weakened and the spirit of the Stability Pact was being violated. The weakening of the Pact had devastating consequences. We urgently require effective and reliable governance that conforms to common economic goals.

Question: The Heads of State or Government recently agreed on tougher rules for the Stability Pact. Is this enough?

Trichet: No. We are asking the Heads of Government, the European Commission and the European Parliament to go further and to be far more rigorous. We need automatic sanctions for excessive deficits. The entire process – from the discovery of looming budget difficulties to the actual imposition of penalties – should be automatic. We saw in the past all the dangers of the complacency of governments.

Question: Is it conceivable that a euro country might leave the single currency?

Trichet: No, that is entirely unrealistic. There’s not even any provision for it in the EU Treaty. The euro area is a community that shares the same destiny: each member is dependent on the others.

Question: Why is the ECB taking such a tough stance against a rescheduling of Greece’s debt?

Trichet: The adjustment and reform programme agreed by the EU and the International Monetary Fund with Greece does not envisage restructuring. Greece must implement the programme fully and rigorously; this is very important to correct the errors of the past and pave the way for sustainable job creation.

Question: Many Greeks are not accepting this reform programme and taking to the streets.

Trichet: It is never easy when a country has to put right many years of economic and financial mismanagement. Greece has lived beyond its means for years while continually raising public-sector pay. It is absolutely essential to reform the country so that it can stand on its own two feet once again. It is in the Greeks’ own best interests that growth is generated and jobs are created again in future.

Question: In Germany, there is growing discontent among politicians and taxpayers about the billions upon billions of assistance. Does that worry you?

Trichet: When we decided to have a single market with a single currency, we created a strong interdependence. If a member gets into difficulties – despite the surveillance which was supposed to be exercised by the other governments – it is the responsibility of all other countries to oversee the fiscal and economic adjustment. Where necessary, they can support the adjustment, as the IMF does, with non-concessional loans under strict conditionality.

Question: Many people on the streets think otherwise. They’ve been saying things like: “If we give Greece even more money, then we don’t have it here at home – for tax cuts, for example.” What do you say to the German people?

Trichet: I think it is certainly right to say that very strong conditionality is of the essence, and that the loans complementing IMF financing must be non-concessional. On the other hand, it would be very paradoxical for Europeans to appear less united in times of difficulty than other continents. I have no wish to moralise. However, in other parts of the world – Asia, for example – there were no discussions during the Asian crisis. Provided there is strong conditionality, all over the world friends can help each other. But I would also like to say to the Germans: you yourselves have every interest in getting Greece to adjust its economy and for it to be a stable partner in Europe and in the euro area.

Question: Is such scepticism with regard to financial assistance “typically German”?

Trichet: No, you also find it in other countries.

Question: What are the main reasons for the rising inflation in the euro area?

Trichet: The prices of oil and raw materials have risen worldwide. This is also pushing up the consumer price index in the euro area. Our responsibility is to prevent price-setters and social partners from increasing other prices and wages in the medium term. We are there to prevent these second-round effects. Over the medium term prices increases will go back to our definition of price stability: below 2%, close to 2%.

Question: When Chancellor Kohl paved for the way for the euro – not single-handedly, but with real determination – he saw it above all as a political, not an economic, decision. Was this a key conceptual defect of the common currency?

Trichet: That is a very direct question. The fundamental idea of having European unity has always been to guarantee peace, prosperity and stability on our continent. From the outset this has included the idea of a common market. Europeans’ efforts to join closely together and create a single currency have deep roots in European politics. Chancellor Kohl, Chancellor Helmut Schmidt before him, and, with them, many other political leaders across Europe, pressed ahead with the project, knowing that it would combine peace and prosperity. Monetary Union is a resounding success. The scepticism about its capacity to maintain price stability has not been borne out at all. The problem is that not everyone has learnt their lessons from the global financial crisis. We have to re-affirm the visions of Helmut Schmidt and Valéry Giscard d’Estaing and of Helmut Kohl and François Mitterrand.

Question: The promise of taking the decisive step towards political union with the euro has not been kept. Will the promise ever be fulfilled?

Trichet: To fulfil this promise, cooperation between the 27 EU countries, and even more so between the 17 euro countries, must be improved significantly. That much is obvious. Better coordination of fiscal and competition policy over time automatically creates greater political cooperation. At present each of us has his or her own opinion on the long-term outlook for political union in Europe. As a European citizen, I am convinced that we should head further down the path of significantly closer political union. However, this is not one of the European Central Bank’s responsibilities. Jean Monnet once commented that he was unsure what the European political institutional framework would look like in the future, but was sure that today’s improvements would lay the foundations for the European institutional framework of tomorrow.

Question: Do we need a two-speed Europe in order to ensure that the tempo is not dictated by those moving forward more slowly?

Trichet: The European Treaties make no such provision. We have to insist on Member States moving forward together. However, it is also quite clear that if you share a single currency, you must make much more of a joint effort and cooperate much more effectively on economic policy.

Question: What are Europe’s basic values?

Trichet: Europeans are deeply attached to democracy. They are deeply committed to human rights and the market economy. This is fundamental. Europeans also have their own particular way of giving the market economy a social face. This was apparent not least during the crisis. It seems to me that the social market economy, which the Germans are so proud of, was also embraced by the other countries a long time ago. As I see it, the most important thing is: we have a shared cultural identity which is developing from shared roots.

Question: How is this idea of Europe being conveyed to younger people?

Trichet: Peace, prosperity and stability can never – never – be taken for granted. Every country, community and individual must stand up for it time and again. As Europeans, we have more political and geostrategic reasons to forge close ties today than we did right after the Second World War. Back then, the United States of America was the sole major single market. Today we have India, China, Brazil and other emerging countries with a bright future in front of them. That’s good, and that’s exactly what we were aiming for 60 years ago when we created the World Bank. For us Europeans it also means uniting even more so as to take into account the existence of these new economic giants. What I would say to young people is: take a look at the many good reasons that we have for uniting Europe; together we can respond far more effectively to tomorrow’s challenges.

Question: Your term of office as ECB President ends in October. What has been your most significant or most cherished experience in the course of these eight years?

Trichet: As president of such an organisation, you are constantly facing new challenges. From the start there was a tremendous team spirit throughout the ECB, even in the most difficult situations. It is gratifying to note that we do not function simply as an institution, but as true Europeans who are deeply attached to the historic construction that is the European Union.

Question: What significance does the Charlemagne Prize have?

Trichet : Everyone at the ECB is moved and impressed that we – especially in today’s challenging circumstances – are being awarded this prize. I know all about the prize and have attended in the past. It is a very moving and impressive celebration. We were just talking about Europe’s roots. In Aachen, we are at the very roots of Europe.

How well do you know Aachen?

Trichet: I have been to Aachen several times. I am familiar with the big historic buildings, and of course with Charlemagne. At the age of ten I won a prize in a school competition: a medal, struck with a portrait of Charlemagne. A German emperor, a French emperor – it makes no difference.

European Central Bank

Directorate Communications

Press and Information Division

Comentarii

Adauga un comentariu

Adauga un comentariu folosind contul de Facebook

Alte stiri din categoria: Noutati BCE

Banca Centrala Europeana (BCE) explica de ce a majorat dobanda la 2%

Banca Centrala Europeana (BCE) explica de ce a majorat dobanda la 2%, in cadrul unei conferinte de presa sustinute de Christine Lagarde, președinta BCE, si Luis de Guindos, vicepreședintele BCE. Iata textul publicat de BCE: DECLARAȚIE DE POLITICĂ MONETARĂ detalii

BCE creste dobanda la 2%, dupa ce inflatia a ajuns la 10%

Banca Centrala Europeana (BCE) a majorat dobanda de referinta pentru tarile din zona euro cu 0,75 puncte, la 2% pe an, din cauza cresterii substantiale a inflatiei, ajunsa la aproape 10% in septembrie, cu mult peste tinta BCE, de doar 2%. In aceste conditii, BCE a anuntat ca va continua sa majoreze dobanda de politica monetara. De asemenea, BCE a luat masuri pentru a reduce nivelul imprumuturilor acordate bancilor in perioada pandemiei coronavirusului, prin majorarea dobanzii aferente acestor facilitati, denumite operațiuni țintite de refinanțare pe termen mai lung (OTRTL). Comunicatul BCE Consiliul guvernatorilor a decis astăzi să majoreze cu 75 puncte de bază cele trei rate ale dobânzilor detalii

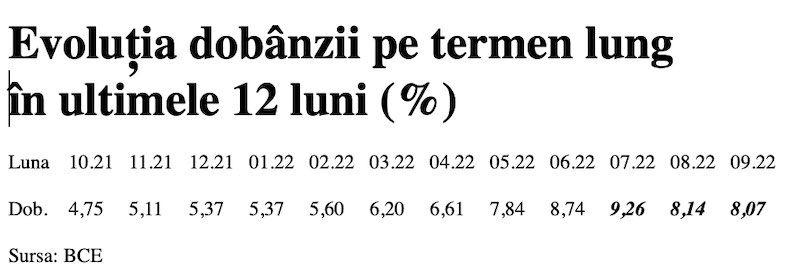

Dobânda pe termen lung a continuat să scadă in septembrie 2022. Ecartul față de Polonia și Cehia, redus semnificativ

Dobânda pe termen lung pentru România a scăzut în septembrie 2022 la valoarea medie de 8,07%, potrivit datelor publicate de Banca Centrală Europeană. Acest indicator, cu referința la un termen de 10 ani (10Y), a continuat astfel tendința detalii

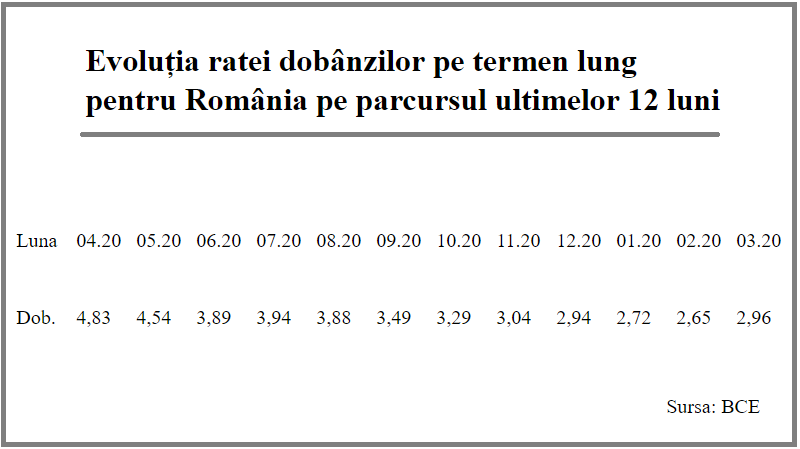

Rata dobanzii pe termen lung pentru Romania, in crestere la 2,96%

Rata dobânzii pe termen lung pentru România a crescut la 2,96% în luna martie 2021, de la 2,65% în luna precedentă, potrivit datelor publicate de Banca Centrală Europeană. Acest indicator critic pentru plățile la datoria externă scăzuse anterior timp de șapte luni detalii

- BCE recomanda bancilor sa nu plateasca dividende

- Modul de functionare a relaxarii cantitative (quantitative easing – QE)

- Dobanda la euro nu va creste pana in iunie 2020

- BCE trebuie sa fie consultata inainte de adoptarea de legi care afecteaza bancile nationale

- BCE a publicat avizul privind taxa bancara

- BCE va mentine la 0% dobanda de referinta pentru euro cel putin pana la finalul lui 2019

- ECB: Insights into the digital transformation of the retail payments ecosystem

- ECB introductory statement on Governing Council decisions

- Speech by Mario Draghi, President of the ECB: Sustaining openness in a dynamic global economy

- Deciziile de politica monetara ale BCE

Criza COVID-19

- In majoritatea unitatilor BRD se poate intra fara certificat verde

- La BCR se poate intra fara certificat verde

- Firmele, obligate sa dea zile libere parintilor care stau cu copiii in timpul pandemiei de coronavirus

- CEC Bank: accesul in banca se face fara certificat verde

- Cum se amana ratele la creditele Garanti BBVA

Topuri Banci

- Topul bancilor dupa active si cota de piata in perioada 2022-2015

- Topul bancilor cu cele mai mici dobanzi la creditele de nevoi personale

- Topul bancilor la active in 2019

- Topul celor mai mari banci din Romania dupa valoarea activelor in 2018

- Topul bancilor dupa active in 2017

Asociatia Romana a Bancilor (ARB)

- Băncile din România nu au majorat comisioanele aferente operațiunilor în numerar

- Concurs de educatie financiara pentru elevi, cu premii in bani

- Creditele acordate de banci au crescut cu 14% in 2022

- Romanii stiu educatie financiara de nota 7

- Gradul de incluziune financiara in Romania a ajuns la aproape 70%

ROBOR

- ROBOR: ce este, cum se calculeaza, ce il influenteaza, explicat de Asociatia Pietelor Financiare

- ROBOR a scazut la 1,59%, dupa ce BNR a redus dobanda la 1,25%

- Dobanzile variabile la creditele noi in lei nu scad, pentru ca IRCC ramane aproape neschimbat, la 2,4%, desi ROBOR s-a micsorat cu un punct, la 2,2%

- IRCC, indicele de dobanda pentru creditele in lei ale persoanelor fizice, a scazut la 1,75%, dar nu va avea efecte imediate pe piata creditarii

- Istoricul ROBOR la 3 luni, in perioada 01.08.1995 - 31.12.2019

Taxa bancara

- Normele metodologice pentru aplicarea taxei bancare, publicate de Ministerul Finantelor

- Noul ROBOR se va aplica automat la creditele noi si prin refinantare la cele in derulare

- Taxa bancara ar putea fi redusa de la 1,2% la 0,4% la bancile mari si 0,2% la cele mici, insa bancherii avertizeaza ca indiferent de nivelul acesteia, intermedierea financiara va scadea iar dobanzile vor creste

- Raiffeisen anunta ca activitatea bancii a incetinit substantial din cauza taxei bancare; strategia va fi reevaluata, nu vor mai fi acordate credite cu dobanzi mici

- Tariceanu anunta un acord de principiu privind taxa bancara: ROBOR-ul ar putea fi inlocuit cu marja de dobanda a bancilor

Statistici BNR

- Deficitul contului curent, aproape 20 miliarde euro după primele nouă luni

- Deficitul contului curent, aproape 18 miliarde euro după primele opt luni

- Deficitul contului curent, peste 9 miliarde euro pe primele cinci luni

- Deficitul contului curent, 6,6 miliarde euro după prima treime a anului

- Deficitul contului curent pe T1, aproape 4 miliarde euro

Legislatie

- Legea nr. 311/2015 privind schemele de garantare a depozitelor şi Fondul de garantare a depozitelor bancare

- Rambursarea anticipata a unui credit, conform OUG 50/2010

- OUG nr.21 din 1992 privind protectia consumatorului, actualizata

- Legea nr. 190 din 1999 privind creditul ipotecar pentru investiții imobiliare

- Reguli privind stabilirea ratelor de referinţă ROBID şi ROBOR

Lege plafonare dobanzi credite

- BNR propune Parlamentului plafonarea dobanzilor la creditele bancilor intre 1,5 si 4 ori peste DAE medie, in functie de tipul creditului; in cazul IFN-urilor, plafonarea dobanzilor nu se justifica

- Legile privind plafonarea dobanzilor la credite si a datoriilor preluate de firmele de recuperare se discuta in Parlament (actualizat)

- Legea privind plafonarea dobanzilor la credite nu a fost inclusa pe ordinea de zi a comisiilor din Camera Deputatilor

- Senatorul Zamfir, despre plafonarea dobanzilor la credite: numai bou-i consecvent!

- Parlamentul dezbate marti legile de plafonare a dobanzilor la credite si a datoriilor cesionate de banci firmelor de recuperare (actualizat)

Anunturi banci

- Cate reclamatii primeste Intesa Sanpaolo Bank si cum le gestioneaza

- Platile instant, posibile la 13 banci

- Aplicatia CEC app va functiona doar pe telefoane cu Android minim 8 sau iOS minim 12

- Bancile comunica automat cu ANAF situatia popririlor

- BRD bate recordul la credite de consum, in ciuda dobanzilor mari, si obtine un profit ridicat

Analize economice

- Inflația anuală a crescut marginal

- Comerțul cu amănuntul - în creștere cu 7,7% cumulat pe primele 9 luni

- România, pe locul 16 din 27 de state membre ca pondere a datoriei publice în PIB

- România, tot prima în UE la inflația anuală, dar decalajul s-a redus

- Exporturile lunare în august, la cel mai redus nivel din ultimul an

Ministerul Finantelor

- Datoria publică, 51,4% din PIB la mijlocul anului

- Deficit bugetar de 3,6% din PIB după prima jumătate a anului

- Deficit bugetar de 3,4% din PIB după primele cinci luni ale anului

- Deficit bugetar îngrijorător după prima treime a anului

- Deficitul bugetar, -2,06% din PIB pe primul trimestru al anului

Biroul de Credit

- FUNDAMENTAREA LEGALITATII PRELUCRARII DATELOR PERSONALE IN SISTEMUL BIROULUI DE CREDIT

- BCR: prelucrarea datelor personale la Biroul de Credit

- Care banci si IFN-uri raporteaza clientii la Biroul de Credit

- Ce trebuie sa stim despre Biroul de Credit

- Care este procedura BCR de raportare a clientilor la Biroul de Credit

Procese

- ANPC pierde un proces cu Intesa si ARB privind modul de calcul al ratelor la credite

- Un client Credius obtine in justitie anularea creditului, din cauza dobanzii prea mari

- Hotararea judecatoriei prin care Aedificium, fosta Raiffeisen Banca pentru Locuinte, si statul sunt obligati sa achite unui client prima de stat

- Decizia Curtii de Apel Bucuresti in procesul dintre Raiffeisen Banca pentru Locuinte si Curtea de Conturi

- Vodafone, obligata de judecatori sa despagubeasca un abonat caruia a refuzat sa-i repare un telefon stricat sau sa-i dea banii inapoi (decizia instantei)

Stiri economice

- Datoria publică, 52,7% din PIB la finele lunii august 2024

- -5,44% din PIB, deficit bugetar înaintea ultimului trimestru din 2024

- Prețurile industriale - scădere în august dar indicele anual a continuat să crească

- România, pe locul 4 în UE la scăderea prețurilor agricole

- Industria prelucrătoare, evoluție neconvingătoare pe luna iulie 2024

Statistici

- România, pe locul trei în UE la creșterea costului muncii în T2 2024

- Cheltuielile cu pensiile - România, pe locul 19 în UE ca pondere în PIB

- Dobanda din Cehia a crescut cu 7 puncte intr-un singur an

- Care este valoarea salariului minim brut si net pe economie in 2024?

- Cat va fi salariul brut si net in Romania in 2024, 2025, 2026 si 2027, conform prognozei oficiale

FNGCIMM

- Programul IMM Invest continua si in 2021

- Garantiile de stat pentru credite acordate de FNGCIMM au crescut cu 185% in 2020

- Programul IMM invest se prelungeste pana in 30 iunie 2021

- Firmele pot obtine credite bancare garantate si subventionate de stat, pe baza facturilor (factoring), prin programul IMM Factor

- Programul IMM Leasing va fi operational in perioada urmatoare, anunta FNGCIMM

Calculator de credite

- ROBOR la 3 luni a scazut cu aproape un punct, dupa masurile luate de BNR; cu cat se reduce rata la credite?

- In ce mall din sectorul 4 pot face o simulare pentru o refinantare?

Noutati BCE

- Acord intre BCE si BNR pentru supravegherea bancilor

- Banca Centrala Europeana (BCE) explica de ce a majorat dobanda la 2%

- BCE creste dobanda la 2%, dupa ce inflatia a ajuns la 10%

- Dobânda pe termen lung a continuat să scadă in septembrie 2022. Ecartul față de Polonia și Cehia, redus semnificativ

- Rata dobanzii pe termen lung pentru Romania, in crestere la 2,96%

Noutati EBA

- Bancile romanesti detin cele mai multe titluri de stat din Europa

- Guidelines on legislative and non-legislative moratoria on loan repayments applied in the light of the COVID-19 crisis

- The EBA reactivates its Guidelines on legislative and non-legislative moratoria

- EBA publishes 2018 EU-wide stress test results

- EBA launches 2018 EU-wide transparency exercise

Noutati FGDB

- Banii din banci sunt garantati, anunta FGDB

- Depozitele bancare garantate de FGDB au crescut cu 13 miliarde lei

- Depozitele bancare garantate de FGDB reprezinta doua treimi din totalul depozitelor din bancile romanesti

- Peste 80% din depozitele bancare sunt garantate

- Depozitele bancare nu intra in campania electorala

CSALB

- La CSALB poti castiga un litigiu cu banca pe care l-ai pierde in instanta

- Negocierile dintre banci si clienti la CSALB, in crestere cu 30%

- Sondaj: dobanda fixa la credite, considerata mai buna decat cea variabila, desi este mai mare

- CSALB: Romanii cu credite caută soluții pentru reducerea ratelor. Cum raspund bancile

- O firma care a facut un schimb valutar gresit s-a inteles cu banca, prin intermediul CSALB

First Bank

- Ce trebuie sa faca cei care au asigurare la credit emisa de Euroins

- First Bank este reprezentanta Eurobank in Romania: ce se intampla cu creditele Bancpost?

- Clientii First Bank pot face plati prin Google Pay

- First Bank anunta rezultatele financiare din prima jumatate a anului 2021

- First Bank are o noua aplicatie de mobile banking

Noutati FMI

- FMI: criza COVID-19 se transforma in criza economica si financiara in 2020, suntem pregatiti cu 1 trilion (o mie de miliarde) de dolari, pentru a ajuta tarile in dificultate; prioritatea sunt ajutoarele financiare pentru familiile si firmele vulnerabile

- FMI cere BNR sa intareasca politica monetara iar Guvernului sa modifice legea pensiilor

- FMI: majorarea salariilor din sectorul public si legea pensiilor ar trebui reevaluate

- IMF statement of the 2018 Article IV Mission to Romania

- Jaewoo Lee, new IMF mission chief for Romania and Bulgaria

Noutati BERD

- Creditele neperformante (npl) - statistici BERD

- BERD este ingrijorata de investigatia autoritatilor din Republica Moldova la Victoria Bank, subsidiara Bancii Transilvania

- BERD dezvaluie cat a platit pe actiunile Piraeus Bank

- ING Bank si BERD finanteaza parcul logistic CTPark Bucharest

- EBRD hails Moldova banking breakthrough

Noutati Federal Reserve

- Federal Reserve anunta noi masuri extinse pentru combaterea crizei COVID-19, care produce pagube "imense" in Statele Unite si in lume

- Federal Reserve urca dobanda la 2,25%

- Federal Reserve decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent

- Federal Reserve majoreaza dobanda de referinta pentru dolar la 1,5% - 1,75%

- Federal Reserve issues FOMC statement

Noutati BEI

- BEI a redus cu 31% sprijinul acordat Romaniei in 2018

- Romania implements SME Initiative: EUR 580 m for Romanian businesses

- European Investment Bank (EIB) is lending EUR 20 million to Agricover Credit IFN

Mobile banking

- Comisioanele BRD pentru MyBRD Mobile, MyBRD Net, My BRD SMS

- Termeni si conditii contractuale ale serviciului You BRD

- Recomandari de securitate ale BRD pentru utilizatorii de internet/mobile banking

- CEC Bank - Ghid utilizare token sub forma de card bancar

- Cinci banci permit platile cu telefonul mobil prin Google Pay

Noutati Comisia Europeana

- Avertismentul Comitetului European pentru risc sistemic (CERS) privind vulnerabilitățile din sistemul financiar al Uniunii

- Cele mai mici preturi din Europa sunt in Romania

- State aid: Commission refers Romania to Court for failure to recover illegal aid worth up to €92 million

- Comisia Europeana publica raportul privind progresele inregistrate de Romania in cadrul mecanismului de cooperare si de verificare (MCV)

- Infringements: Commission refers Greece, Ireland and Romania to the Court of Justice for not implementing anti-money laundering rules

Noutati BVB

- BET AeRO, primul indice pentru piata AeRO, la BVB

- Laptaria cu Caimac s-a listat pe piata AeRO a BVB

- Banca Transilvania plateste un dividend brut pe actiune de 0,17 lei din profitul pe 2018

- Obligatiunile Bancii Transilvania se tranzactioneaza la Bursa de Valori Bucuresti

- Obligatiunile Good Pople SA (FRU21) au debutat pe piata AeRO

Institutul National de Statistica

- Deficitul balanței comerciale la 9 luni, cu 15% mai mare față de aceeași perioadă a anului trecut

- Producția industrială, în scădere semnificativă

- Pensia reală, în creștere cu 8,7% pe luna august 2024

- Avansul PIB pe T1 2024, majorat la +0,5%

- Industria prelucrătoare a trecut pe plus în aprilie 2024

Informatii utile asigurari

- Data de la care FGA face plati pentru asigurarile RCA Euroins: 17 mai 2023

- Asigurarea împotriva dezastrelor, valabilă și in caz de faliment

- Asiguratii nu au nevoie de documente de confirmare a cutremurului

- Cum functioneaza o asigurare de viata Metropolitan pentru un credit la Banca Transilvania?

- Care sunt documente necesare pentru dosarul de dauna la Cardif?

ING Bank

- La ING se vor putea face plati instant din decembrie 2022

- Cum evitam tentativele de frauda online?

- Clientii ING Bank trebuie sa-si actualizeze aplicatia Home Bank pana in 20 martie

- Obligatiunile Rockcastle, cel mai mare proprietar de centre comerciale din Europa Centrala si de Est, intermediata de ING Bank

- ING Bank transforma departamentul de responsabilitate sociala intr-unul de sustenabilitate

Ultimele Comentarii

-

LOAN OFFER

Buna ziua Aceasta pentru a informa publicul larg că oferim împrumuturi celor care au nevoie de ... detalii

-

!

Greu cu limba romana! Ce legatura are cuvantul "ecosistem" din limba romana cu sistemul de plati ... detalii

-

Bancnote vechi

Am 2 bancnote vechi:1-1000000lei;2-5000000lei Anul ... detalii

-

Bancnote vechi

Numar de ... detalii

-

Bancnote vechi

Am 3 bancnote vechi:1-1000000lei;1-5000lei;1-100000;mai multe bancnote cu eclipsa de ... detalii