On 16 December 2015, the US Federal Reserve raised its federal funds rate by 0.25 per cent to the target range of between 0.25 to 0.5 per cent. The long-expected hike will likely increase market volatility and the cost of funding in EBRD countries, said EBRD in a statement.

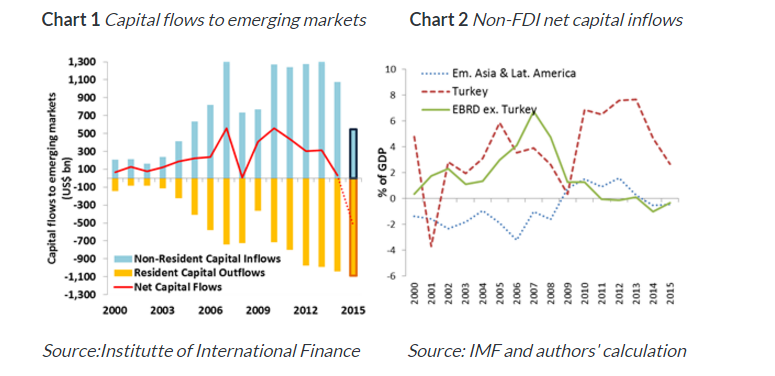

This may affect their growth prospects, although the impact is likely to be limited, given that most EBRD countries were not among the major beneficiaries of post-crisis capital inflows. Within this limited effect, EBRD countries will be affected to a varying degree:

- Countries that are perceived by the markets as having weaker fundamentals or as being exposed to geopolitical uncertainties (for example Turkey, Russia and Ukraine) may be affected more;

- Countries with larger short-term and portfolio liabilities and those with a larger share of dollar-denominated liabilities (for example Jordan, Ukraine, and Turkey) may be affected more;

- Countries with close links to the eurozone (Central Eastern and South Eastern Europe) will continue to benefit from accommodating monetary policy by the European Central Bank (ECB), translating into lower interest rates and better trade prospects.

On balance, among EBRD countries more exposed to market volatility and rising cost of funding is likely to be Turkey which benefited most from post-crisis capital inflows, and where reliance on dollar capital inflows and the share of dollar-denominated debt are higher than in other EBRD countries, although the impact may be limited as some of it has already been priced in by markets.

There may be temporary implications for commodities exporters such as Russia as oil and other commodity prices may fall on the stronger dollar. This is clearly a second-order effect and prices will remain dominated by more fundamental forces.

Countries in Eastern Europe, the Caucasus and Central Asia will be affected indirectly through their exposure to Russia and may see their cost of funding rise slightly, particularly those with a higher share of unhedged dollar-denominated debt.

The Southern and Eastern Mediterranean countries may face higher costs of funding, given that most of their investors are dollar-based, but the overall impact is likely to be limited.

Faced with somewhat lower portfolio inflows, EBRD countries may benefit from alternative sources of funding, such as FDI, private equity, public-private partnerships, and more efficient use of domestic sources of funding through building deeper local capital markets.

See more here